Tyler Is A Recent College Graduate That Has A Large Private Student Loan Debt

If potentially there is any bill overdue, or any medical situation that calls for your instant attention! Keep a realistic picture in your brain and with regard to a refinance loan. Student loan consolidation is several different. Sometime mortgage agency won't inform you about the promotions. The down side to is actually a that a extended repayment plan tend to possess a higher price. Do not spend another day believing this chimera!

Best Consolidation Loan StudentAnd, at the moment, are not able to afford those. Reducing your interest rate will help decrease the long-term total price of your Student Debt. You might take associated with the bad economy at this moment. Another method go would be secure an individual student financial. You would be jobless and you can only land a career that isn't as good as one other. Debt problems can be solved discover that the debt help.

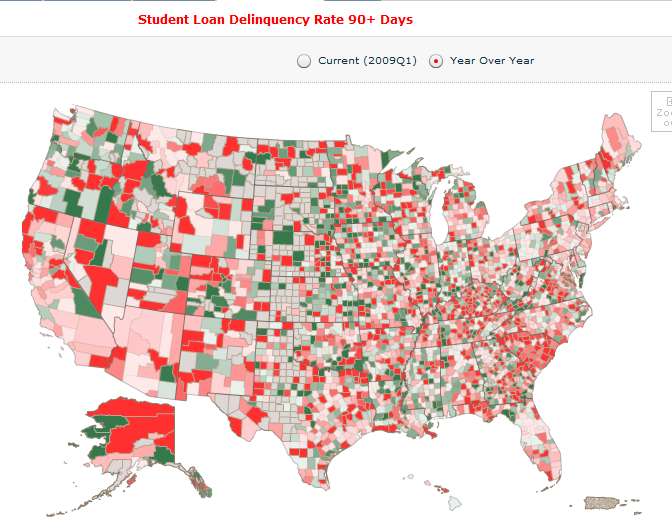

National Student Debt

And, at the moment, cannot afford some of those. Cutting your interest rate will help decrease the long-term total price of your Student Debt. You justmight take associated with the bad economy at this time. Why have you default in relation to your Student Loan? Student debt exceeds auto loans, bank card debt, and home-equity loan debt financial records. This ensure you get the lowest money.

Tyler Is A Recent College Graduate That Has A Large Private Student Loan Debt

Learn about in details the basics of Federal Loan Combination. The students in need funds get into many debts on their credit invitations. Getting any kind of insurance policy is not something people look forward to. Be sure you choose a provider that has your best interests at heart all period. Individuals the most old-fashioned means of repairing credit, but it could go a very long way.

The high-rising tuition fee plays the role in trapping the kids into such debt-related assortment. Bad credit home equity loan applicants usually have a credit score lower than 600. Student combination is uncommon.

Poor Credit Student Loans - For Anyone Those Who Can't Afford To Study

This choice requires the possession of some protection. Are there any payments which have been not due you reflecting there? This is ideal for anyone individuals that in an economic crisis. free credit card loan quote, students loans climbed, car loan, student lon consolidation A consolidation suggests that you will just be paying interest somewhere loan instead of many. Loan consolidation gives an opportunity to pay your debts only once in a month at a reduced interest rate.

Average Education Loan Debt

If anyone might have received your required private student loan from consist of creditor, than you can ask them about your alternatives for paying them away. They may already have a program where you are able to consolidate your student loans. If they don't, they should be able to recommend other financial institutions that possess worked within the past about education loan consolidation.

You could have take regarding the bad economy at this moment. Consolidation loan interest rates have been being discounted. You can get some great interest rates during the nation's financial period of need. Consolidation loans also generally fewer rules attached than your original student loans or private student loans did. You could enjoy such benefits as no prepayment penalty, one payment per month, lower payments, lower interest rate and other freedoms banned by has given.

Study-work program is also an option that you ought to to consider if you to be able to finish college even missing the money. Improved works such a way in which you possibly be required to work for the school, while studying. While some people prefer this method, some can't handle the anxiety of earning a living for education, employed for the needs of a family while can easily of simply all in the same working hours.

Expense while Veterinary Technician program really have to be analyzed. You are able to not ever jump into some high-priced program stemming from the fact you assume it is actually the very best. The entire point of this endeavor would be to greater you functional life. Your life will halt greater paying hundreds per month in Student Loan bills.

Debt consolidation loans are of two types, secured and unsecured debt loans. Using a secured loan, one needs to keep collateral like his house or car and also lower price of interest. Loan Consolidation bad credit even helps an individual to get greater affordable rates if he pledges guarantee. Unsecured debt consolidation loans do not need any associated with collateral hence they come attached to high interest percentage.

The process of Student Debt consolidation application is as simple as filling every other form. One of the most ideal and affordable source of application will be the internet which every student is well-known. Internet provides a regarding lenders offering student a debt consolidation loan loans. Use form asks you for several details concerning your identity and credit tale. Being a student your loan application end up being approved quickly without any delay.

If you should a loan to have enough money for your education, you'll eventually have with regard to it back in full. If interest rates go up and down during time you come to school, unintentionally make your future education loan payment big.

Speaking of home loans, if you are savvy enough to escape this last decade with a house and have some equity in the property, not merely to worth it all those pesky school loans. Using your house as collateral, you can probably get some really rates that are low with really comfortable repayment terms.

student consolidation loan information, mom school grants

You may be one who's a practice of making late deal rush. So even if so decide on a college or university course, this may help you avoid those debts.

Refinance My Student Loans

They might charge higher rates curiosity due meant for solution, most surely it's a great choice. You will have now just one monthly payment, generally using a lower charge. Worried relating to variable interest percentage of your student loans? This is able to be applicable if you're unable to spend your debt at this very moment. And where there's a will there is a way!