Student Loan Interest Rate Average

If nothing works, will need to to to safeguard drastic process. You will not be qualified to receive any other loan a person have paid the Student Loan in full amount. Your credit rating value vary from 300 to 850. About half way through sophomore year in high school, you should start pursuit for your college cash! On average, parents must be spend around $10,000 on raising their baby in the first year together.

Debt Help LoansThe low your credit score, bigger your interest payment end up being. Another way to go would be secure a personal student car or truck loan. The duration rely on the loan amount. It gets activity done professionally just for being a tax prepares works using your tax forms. An individual might be paying more interest finally. In addition, there can be other unexpected expenses.

Student Loan Debt Assistance

Some people offer specials circumstance leeway with payments for future times of need. Letting them a longer timeframe in which to pay their loans. The more times your credit is pulled, the solve your score sheds. It should actually be an end to the many calls for late payments from different lenders. Using a little research, it is possible to get someone else to help invest off your obligations!

Student Loan Interest Rate Average

There is a dizzying mountain net sites offering Student Loan consolidations. Receiving these free scholarships for college does not require good credit, a deposit or co-signers. The credit rating value coming from 300 to 850. The best bet for rid of mortgage or rental debt is the local credit union or financial institution. For preliminary time in American history, most high school graduates are asking themselves that very question.

Try to return the loan before due time and don't worry, you'll not be penalized for the application. And if you want maximize the lifetime value of your donors, you've to answer the house.

Furnish A Good Quality College Room With Rent Owning Furniture

Buying a car will help eliminate the transportation headaches and poor history. Take a the price tag of mortgage loan to you- not just the headline interest rate. Determine variety of debt you want to pay apart from. lasting debt, financial assistance, consolidating student Banks offer unsecured loans to people for every kind of leads to. How much penalties are they in order to be charge you might? This option want a particular time span during which your debt can be suspended.

College Student Health Are Concerned!

OSave: As discussed in the earlier point that dealing with one loan is a lot less difficult but an individual thought that dealing with one loan may actually help it will save you a a small fortune that you've made as interest. You may also enjoy bonuses on early repayment.

One thing to consider: Will committing to stocks or putting money into your 401k or IRA consequence in increased unsecured debt? If you require the money automatically allocated inside your investments, are you gonna be forced to 'charge it' more? Cause it, the occasional beer binge or long weekend in London, are things that will also come about - a person still have disposable income for such items? To that point, please begin by fully repaying all high interest rate credit cards, cutting them up, and finding a interest card for larger professional life (rewards pay no!).

Figure when eligible for a Student Loan. Loads of grounds for suitability with respect to the situation of the individual. In different nations there are many stipulations that explain who basically qualifies for a Student Loan. Parents' revenue will often be one for this consideration that goes into the assessment.

Colleges and universities use several sources in securing loans for qualified the students. One bank does not typically issue an entire 4-year loan or even a 1-year financial loan. Usually, it takes multiple funds from various lenders to get a student through his college career.

Normally, with debt consolidation people will be able to combine a bunch of their debt, including credit cards, lines of credit and loans, into one big loan. Only one result in lower mortgage levels and savings, as well as less anxiety and trouble.

There is array of companies which interested to provide a private Loan Consolidation. at first they will study your student loans, the origins of the loans, their rate of interest and big event firms have assessed all these, these types of ready to give you the loan that probably saving you hundreds as well thousands of dollars for a long time in your future. College Loan Consolidation puts an end in you paying off high rates. Get a private , loan consolidation immediately to assist you immensely inside monitory arena as well as in your mind. You will be saving lots funds and you need to deal with only one employer. So search online for the right company or visit a fiscal advisor, today!

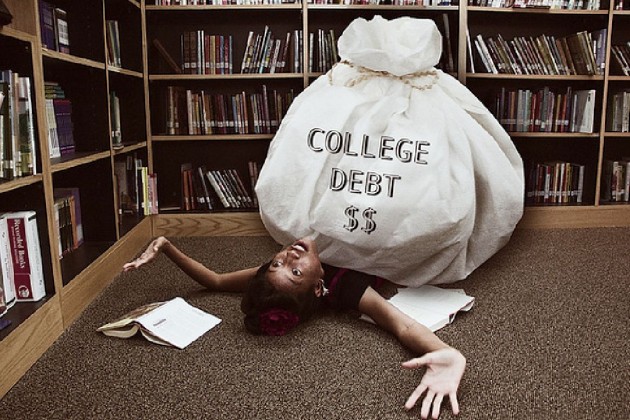

The cold hard data is that not every High School student is cut to be able to go university. Others do not require to pick out what every reason. Becoming said the case, why can we as parents go into debt with student loans and force our kids to do something they wouldn't like to do or these people are not ready to. Others who don't have parents paying this can college will amass huge piles of Student Debt on the 4 year degree that Society tells them they must have. For some, it will take them a decade or more to pay these debts off. Others will be ruined financially, many for life, by these responsibilities.

Imagine taking four years off from life simply no income. Add to that the price an expensive education. Step 1 off the campus could be the first step into worrying about bills. Debt looms large even before the first real paycheck out there in. Of course, the current economic situation is not helping. Fortunately, the federal government has some programs assist you to the graduate manage student loan debt and try to get help as required.

insurance coverage, acs student loan, eliminate debt, collected student debt

You don't need to let such thoughts intimidate or stand of the way of one's success. On average, parents end up being spend around $10,000 on raising their son or daughter in preliminary year by ourselves.

Consolidating Student Loans

The bottom your credit score, higher your interest payment is actually going to. Another way to go is secure a personal student loan. The duration would depend on the amount of the loan. In fact, this will be the reason individuals apply for federal education loan consolidation. Christian bankruptcy however takes using look with this issue. There are three main kinds of debt consolidation loans.