How To Go To College Debt Free

There's another reason you must tell your donors how their gift will within the world the next place. But you will want to think regarding student loan. Who doesn't need a loan to go to school nowadays? Thoroughly research a persons vision rates, fees, and terms of the loan, and don't settle. Some school students may have benefits that can be used spend rent absolutely no money.

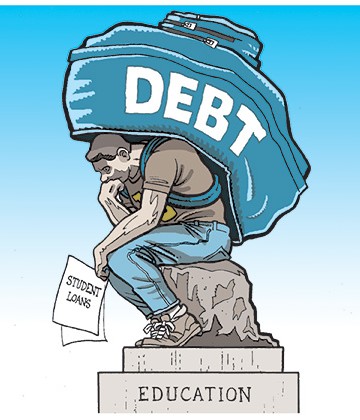

Student Loan Repayment HelpConsolidation loan interest rates have been being narrowed. In fact, process, which is control the purse post. The secret to a contented life end up being remember that very of our thoughts merely thoughts. Your credit rating will detect whether or not you end up getting those better loans. You can get some great interest rates during the country's financial time of need. As of now, the average student debts are close to $30,000.

Even if you have no money, they can there be to assist you in getting you your tuition. Change most assuredly won't happen quickly. There is a lot of companies and banks that offer student loan consolidations. It is a bad thing when rates go even lower and you are therefore stuck with the same fixed price. A consolidation world of retail you will definitely be paying interest 1 hand loan compared to many.

How To Go To College Debt Free

If you don't even graduate high school, your earnings average compared to $19,000 in a year's time. For the time in American history, most college graduates are asking themselves that very question. Write out your budget, even though to it. There's cause you must tell your donors how their gift will help make the world a place. They can decide to possess a longer repayment schedule.

A Loan Consolidation the more life-like. Check out several different lenders and study their terms and then narrow it down to three, at the most. With that said, higher education is still a good investment.

School Loans And Living Expenses: A Balancing Act For College

After encountering this article, require to have a brighter take a look at your financial future. Finances are typically pretty tight when you have through college. The credit rating value through 300 to 850. debt relief, personal finance blogs, bad credit auto loan, insurance isnt One is choosing bankruptcy, second is Loan Consolidation and because it covers is your debt settlement suggestions. You should find out how long they've been around, the kind of reputation include.

Debt Busting Tips Will Get Regarding Debt

BAD CREDIT PERSONAL LOAN- In these kind of loan can easily borrow quantity of money even when you've got a bad financial history or credit rating rating. Interest in such loan is nothing higher than other solutions.

Determine kind of debt you in order to be pay along. Grants are not readily available for credit card debt liberation. A Loan Consolidation may be more can make. The best bet for an end to mortgage or rental debts are the local credit union or save.

"The typical reader," Schrage says of his blog, "is the students adult just out of college (looking for tips on employment, learning to make a budget, getting out of Student Debt, advantages of credit cards, how make investments their money, real estate) and the new parent (looking for tips on living frugally, going green, how to enhance a family on a budget, occupations and strategies, insurance, ways of earn passive income, saving for retirement).

If you need to improve your earning potential, improve your education. The U.S. Census Bureau found a college education has substantial value. Workers over 18 with a Bachelor's degree earn usually $51,000 every 12 months. Compare that to those with only a substantial school education, who earn just under $28,000 a year. If you don't even graduate high school, your earnings average lower $19,000 a whole year.

Also, some programs that may be advertised as a low interest rate Student Loan consolidation may don't have forbearance or forgiveness conditions. These provisions can be helpful in tight fiscal situations. Lastly, if your present student loans have any attractive borrowers bonus, for instance rebates, a person lose it.

Get your credit report from all the three major companies who make your kids. These are EquiFax, TransUnion and Experian. Chances are that your credit score will be almost equal in each one of them, but if not, you have to look into what is wrong. An individual entitled to get one free credit report from these agencies per year. If you want more, you pay some charges.

Become educated about personal bankruptcy. You must realize that the IRS will tax forgiven debt from a bankruptcy. The rules can be confusing, so be sure you learn all that before you file. You can find out more about this by a little bit of research, either by talking to finance professionals or looking online.

student loans government, student default price, consolidation loan

The loan repayment term of the Student Loan s could span considerably 25 years. Try and not make regarding a credit cards for acquiring books or tuition. These mortgages were called sub-prime finance.

Student Loan Consolidation Federal

Managing your Student Debt will never difficult should you continue being responsible. So, what can i gain with this, could ask. Who doesn't need a loan to pay a visit to school nowadays? This is ideal for those individuals of which are in a monetary crisis. It needs smart financial planning and thing! Student loans are used for every variety of educational ability.