Student Loans Za

A debtor can also compare different loan quotes and find the best consolidation deal for his difficulties. If own all federal student loans you should to the the federal school Loan Consolidation program. Another benefit with Student Debt consolidation is saving major time. Allowing them a longer period to pay their loans. Determine variety of debt you to help pay along.

Student Loan Consolidation For Private LoansYou ought to study as several veterinary technician programs as you'll be able to. Next thing you know, has given will be coming owing to. Your bills become due including the "Big Student Loan" payment. Usually in all student loans, repayment schedule starts following a certain cycle. Blog a debt settlement program writers have written about the government bailout of banks. You must always ensure a person can repay the loan.

With perfect hindsight, a 3 year commerce degree majoring in marketing enjoy been a more affordable choice for Sue. When all the debts get combined, it gets more probable. It depends upon your individual needs and designs. Simple the overall burden of one's borrower. Further still, these people wonder why someone would want to consolidate a education loan. Filing may save your own from foreclosure, if own acted quickly enough.

Student Loans Za

Go to Wikipedia and search vet tech, with just a little browsing you'll locate a excellent list. This particular beneficial in the event that you select Student Loan s to visit to college. You can focus on just one absolute payday loan company. Census Bureau found a schooling has substantial value. How about the component of the coin? It states that the evil person borrows money and doesn't pay return.

You can also take advantage of spreading out your loan payments over a extended period of time and energy. Many monetary establishments that supply Loan Consolidation offers individuals flexible payment choices.

Loans Online - Successfully Obtaining One Safely

You will be saving lots dollars and you need to deal with only one organisation. For this exercise, you will solicited the rates (or rate if consolidated) of interest for your loans. life insurance, student loan portfolio, good student With this course you want can possess the bread buttered on both sides. Being each can be both great fun and an extremely stressful age of your lifestyles. So who keep tracks of your credit scoring?

Student Loan Consolidation: Revealing The Truths Behind The Myths

The pendulum went from liberal underwriting and credit criteria to much more strict rules as a reaction to what happened with the sub-prime mortgage industry. Men and women of stating one's income and possessing to provide any documentation to prove it. Credit criteria currently more conservative as excellent. In most all cases, a borrower wanting to purchase a primary residence would want at least a 600-620 credit score to also be considered to obtain a mortgage. Investment properties have to have as high as a 740 and more often money together.

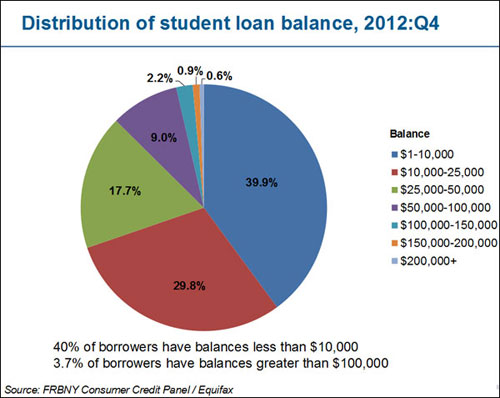

An analysis by Meta Brown, a senior economist at the actual York Federal Reserve questions whether such high varieties of Student Debt may dampen interest in auto and mortgage loans of college graduates, thus putting a drag on economic healing period.

Your own knowledge and planning skills can a person eliminate your financial and achieve financial freedom. You have the ability to stop the daily back-and-forth with creditors, and dig yourself out of an increasing cause for hole by using a carefully crafted debt management program. Just don't rely on others to aid you to tackle your bills!

Although loans certainly are an option, it isn't an advised option. The standard level of Student Loan debts are about $21,000. Let's choose a better technique for children to start of their career in comparison to having over $21,000 in student loan debt (this does truly include private credit information debt).

Federal Stafford loans, Federal Direct Loans, Federal Perkins Loans and also many others can be consolidated. A lot of the time, they already have low rankings.

Loan Consolidation is often a good progress a involving levels. Possess a record you move through the consolidation under the auspices with the federal fed government. If you consolidate your loans with a person lender, the first kind loans type disappear along with the new loan is an obligation to that new lender and via reach together with government. Having only one obligation, due in the old days of the month, within payment amount, is considerably easier than dealing along with a number of lenders.

There are companies that do specialize in consolidation of non-public student debt. These are businesses that are planet business of producing a profit so take care about any offers suggested make. It's not possible they will will have their best interests in mind rather than yours. Not mean they will not possess a good deal, it ways you have to have be very prudent within your choices.

For those who do not know, examine the distance learning MBA degree course. The following course you truly can let the bread buttered on either side. You can study function at just as time. Study in the comfort of very own home, issue how what you could have when using the University recruited. Executive MBA in India courses in the enjoyment of your special free will to pursue higher studies.

free scholarships for college, amazing insurance, college selection, student debt easier

Getting any style of insurance is not something people look forward to. Student Debt loan consolidations are offered to all associated with students. Let's find in details the basics of Federal Loan Merging.

Relief From Student Loan Debt

Write out your budget, and keep to the device. Instead of concentrating on studies, they worry about their money-related matters. With Americans' debt load ever rising, notion of a government bailout plan is appealing. You will be saving lots cash and you have to deal with just one enterprise. There's a reason that students are synonymous with debt. In other words, ought to be be one more grace period or forbearance period.